Closed Transactions by Solomon Stanley Financial

With over 40 years of combined expertise and more than $5 billion in capital placed, Solomon Stanley Financial has successfully closed +300 transactions across a multitude of asset classes and financing types. Our proven track record encompasses strategic debt and equity placements for multifamily, retail, industrial, office, hotel, and specialty properties nationwide.

Our Proven Track Record in Capital Advisory

Solomon Stanley Financial excels in structuring sophisticated financial solutions for real estate investors and developers. Backed by a family office with over $350 million AUM, our nimble team delivers unmatched speed, flexibility, and precision throughout the capital placement process. Our expertise ensures your projects not only reach the finish line but also exceed expectations.

Browse our extensive portfolio of closed transactions to discover how we consistently empower clients to capitalize with confidence in constantly evolving market conditions.

Transaction Highlights That Define Our Legacy

Explore Our Distinguished Transactions by Sector

Multifamily

Strategic capital solutions for urban high-rises to suburban complexes, supporting acquisition, development, and value-add repositioning across all market tiers.

Office

Customized financing for high-rise office towers, multi-tenant office complexes, single-tenant properties, owner-user offices, and SBA-backed deals, with specialized Tenant Improvement (TI) capital to enhance functionality and tenant appeal.

Home Builder

Innovative financing solutions for master-planned communities, both for sale and for rent, designed for every phase of residential development.

Hotel & Lodging

Flexible funding ranging from boutique concepts to landmark resorts, supporting construction, renovation, and strategic acquisitions in diverse hospitality markets.

Retail

Strategic capital for shopping centers, mixed-use developments, strip retail centers, and standalone properties that drive exceptional value in evolving consumer environments.

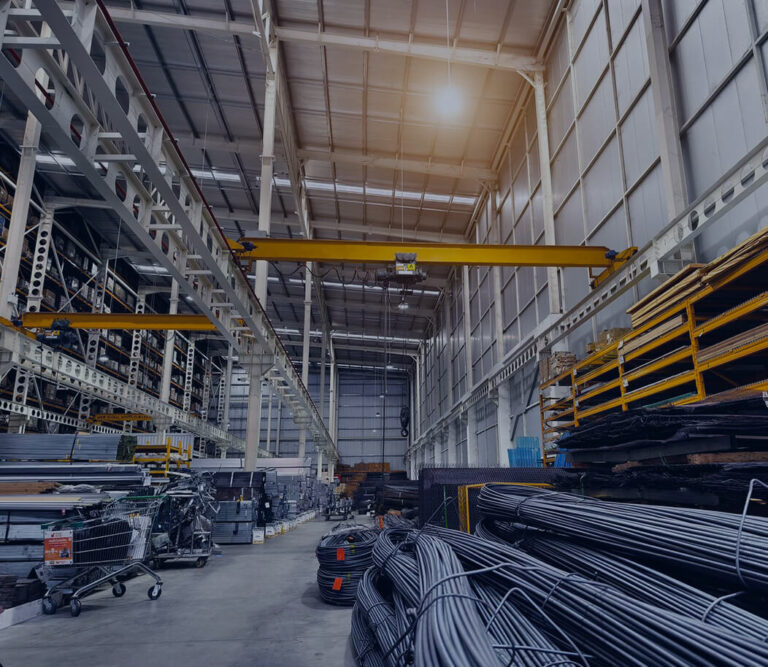

Industrial

Forward-thinking financing for warehouses, distribution centers, industrial outdoor storage, and manufacturing facilities that optimize operational efficiency in this high-demand sector.

Developments

Comprehensive funding solutions for ground-up projects and transformative repositioning efforts that bring visionary real estate concepts to life.

Land

Tailored financing solutions for raw land acquisitions, entitled parcels, and land development projects, enabling investors and developers to secure strategic sites and unlock value through flexible capital structures.

Residential

Specialized financing solutions for luxury single-family, two- to four-unit properties, and condominium projects, helping investors secure the best terms and maximize returns.

The Solomon Stanley Advantage

Our seasoned team combines decades of specialized market knowledge with deep-rooted industry relationships to significantly reduce execution risk and maximize potential returns. Whether structuring senior debt, mezzanine financing, preferred equity, or common equity solutions, we create lasting partnerships built on transparency, trust, and measurable results.

Client Success Stories

Solomon Stanley Financial’s market expertise and extensive relationships helped us close our retail center financing in record time, unlocking significant value for our investors while navigating unprecedented market volatility.

– Michael T., Principal, Retail Development Firm

Their ability to understand our complex multifamily development and structure creative financing solutions made all the difference. Solomon Stanley delivered exactly what they promised—and then some.

– Sarah L., CEO, Multifamily Development Company

Ready to Capitalize With Confidence?

Contact our experienced advisory team today to explore how Solomon Stanley Financial can structure innovative capital solutions for your next real estate transaction. We’re committed to delivering exceptional results that exceed expectations and build long-term relationships.

Talk to My Advisor

"*" indicates required fields