Office Real Estate Transactions

Solomon Stanley Financial structures strategic capital solutions for a broad range of office property types nationwide. Our office financing expertise spans high-rise towers, multi-tenant campuses, single-tenant NNN assets, and owner-user properties. Whether you’re acquiring, developing, or refinancing, we deliver senior debt, mezzanine, preferred equity, JV, or SBA-backed financing tailored to your investment strategy.

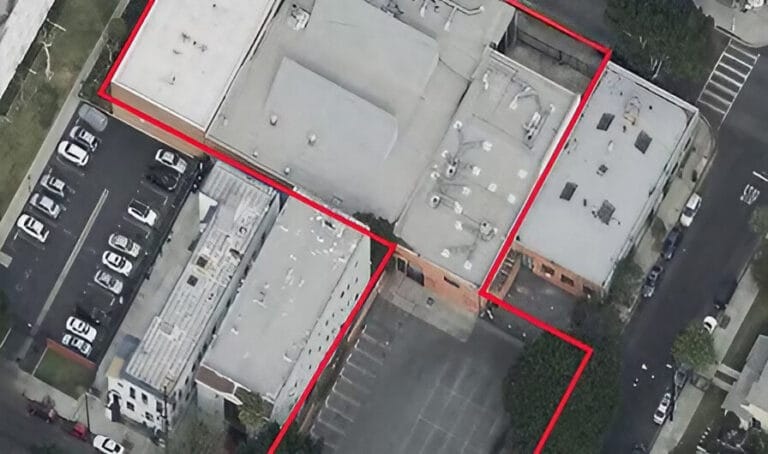

Featured Office Transactions

$17,500,000

$15,000,000

$12,000,000

$8,500,000

$6,390,000

$6,200,000

$5,350,000

$4,500,000

$3,600,000

$1,590,000

$1,095,000

Office Transaction Highlights

Our Office Financing Solutions

Acquisition & Refinance Financing

Flexible capital solutions for stabilized, value-add, and opportunistic office assets—whether high-rise, suburban, or single-tenant. Our execution spans bank, debt fund, CMBS, and life company channels, tailored to occupancy and cash flow profiles.

Owner-User & SBA Financing

Customized financing for owner-occupied office assets, including SBA 504 and 7(a) programs, with competitive terms and streamlined closings for entrepreneurs and small businesses.

Tenant Improvement & Leasing Capital

We structure capital to support tenant improvements (TIs), leasing commissions (LCs), and re-tenanting strategies—key components in repositioning office assets in today’s evolving work environment.

Development & Construction

Ground-up construction financing for office projects, including build-to-suit and speculative development. We help developers align debt and equity with timeline, lease-up, and stabilization milestones.

Joint Venture & Common Equity

Strategic equity partnerships for office investments, including JV structures and common equity solutions that support both short- and long-term ownership strategies.

The Solomon Stanley Advantage

Our office financing team combines decades of experience with real-time market intelligence to deliver capital structures that balance risk, return, and execution certainty. We understand the nuances of office leasing, TI allowances, credit underwriting, and capex planning—delivering solutions that maximize sponsor flexibility and asset performance.

Solomon Stanley’s team delivered creative financing for our multi-tenant office repositioning, including full TI and LC reserves. Their guidance and speed made all the difference.

– Managing Director, Real Estate Investment Firm

Talk to My Advisor

"*" indicates required fields